If you are interested in the derivation, see Reference at the bottom of this page. This formula can be derived from the compound interest formula, based on the fact that the total future value is the sum of each individual payment compounded over the time remaining. When the payment period matches the compound period, rate=r/n and nper=n*t. A = the payment amount, added to the principal at the end of each period.The formula for the future value of a uniform series of deposits or payments is F= A(((1+ rate)^ nper-1)/ rate) where For example, with monthly compounding for a total of 18 months, n=12 and t=1.5 resulting in nper=12*1.5=18.Īdvertisement Compound Interest Formula for a Series of Paymentsįor both loans and savings, we typically want to include a series of payments or deposits in our calculation, such as depositing 100 each month for 3 years. Although the math can handle a decimal value for nper, it should usually be a whole number. This is the same as the basic formula where rate = r/ n and nper = n* t. n = the number of compound periods per year (e.g.r = the nominal annual interest rate in decimal form.P = the principal amount (the initial savings or the starting loan amount).The formula is often written as F = P*(1+ r/ n)^( n* t) with the following variables definitions: nper = the total number of compounding periodsįormula for Compounding Yearly, Monthly, Weekly.rate = the interest rate per compounding period.

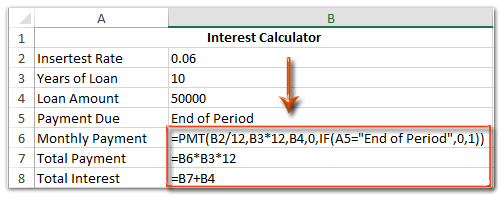

The basic compound interest formula for calculating a future value is F = P*(1+ rate)^ nper where Update - Fixed the Daily compounding option to reference "Daily (365)" Compound Interest Formula Plus, people tend to use spreadsheets in ways I haven't thought of. One of the worksheets in this file is nearly identical to the online calculator above, and was used to help verify the calculations.īETA () - This spreadsheet is currently a BETA version because I haven't tested every possible input combination. The graph compares the total (cumulative) principal and payments to the balance over time. The table is based on the payment frequency and shows the amount of interest added each period.

This spreadsheet was designed as an educational tool - to help show how compound interest works for both savings and loans.

0 kommentar(er)

0 kommentar(er)